The rise in complex real estate transactions presents both opportunities and challenges, particularly in preventing money laundering and safeguarding title insurance. Compliance officers and professionals in the sector must remain aware and well-equipped to meet tightening AML regulations. Truth Technologies Inc. stands at the forefront, offering risk management solutions to address these challenges. With Sentinel™, real estate professionals can help protect their businesses from financial fraud while ensuring adherence to critical compliance standards. Learn more about the latest federal AML real estate rule here.

Navigating AML Regulations

The real estate and title insurance sectors and affiliated agencies, are uniquely vulnerable to financial crimes such as money laundering and fraud. As the volume and complexity of real estate transactions grow, so do the opportunities for illicit activities to infiltrate and threaten these industries.

Understanding how to navigate AML regulations is essential for anyone involved in real estate. These regulations aim to combat financial crime by imposing requirements on various parties engaged in property transactions. The Federal Register provides updated guidelines and rules that must be adhered to. These new regulations will come into effect on January 1, 2026.

Red Flags in Real Estate Transactions

Real estate transactions are vulnerable to numerous red flags. Criminals employ sophisticated methods to exploit system vulnerabilities, making it imperative to be aware of these red flags for implementing effective safeguards.

Here are some red flags:

-

- High-value cash transactions

-

- Complex ownership structures

-

- Last-minute changes in buyer or seller information

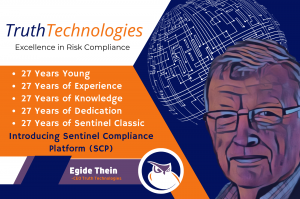

Sentinel™: Your Compliance Technology Solution

Truth Technologies Inc. offers advanced risk management solutions through Sentinel™, which are specifically tailored for real estate professionals.

-

- Compliance checks ensure that all transactions meet KYC standards.

-

- Continuous monitoring identifies and flags suspicious activity promptly.

-

- Comprehensive reporting tools provide detailed insights for auditing and analysis.

These features enable professionals to focus on growing their business while ensuring compliance with industry standards.

Get Started Today

With our comprehensive KYC and AML capabilities, Truth Technologies Inc. rigorously vets every individual and entity involved in your transactions. Our advanced due diligence processes reduce your risk exposure, protect your business integrity, and give you peace of mind.

Implementing AML monitoring with Truth Technologies Inc. helps enable you to:

-

- Satisfy legal and regulatory obligations.

-

- Detect and prevent financial crimes early.

-

- Protect your customers, partners, and your business reputation.

Learn how Truth Technologies Inc. can help your real estate, title insurance, or affiliated agency business stay protected against financial crime risks. Schedule a free demo of our Sentinel Compliance Platform™ and explore enhanced due diligence and AML screening solutions tailored for your industry.