Know Your Customer (KYC) Screening

Know Your Customer Checks & Customer Due Diligence

- Customer identification & risk assessment

- Customer acceptance

- On-going monitoring

- Documentation

Customer Identification & Risk Assessment

- Politically exposed persons (PEP) – those that are high risk because they are in danger of bribery

- Criminals – those that are accused or are suspected of criminal activity, also those that are associated with known criminals

- Government sanctioned entities – includes entries on Office of Foreign Assets Control (OFAC) lists, entities one may not be able to do business with because of nation-wide or other sanctions

Customer Review and Acceptance

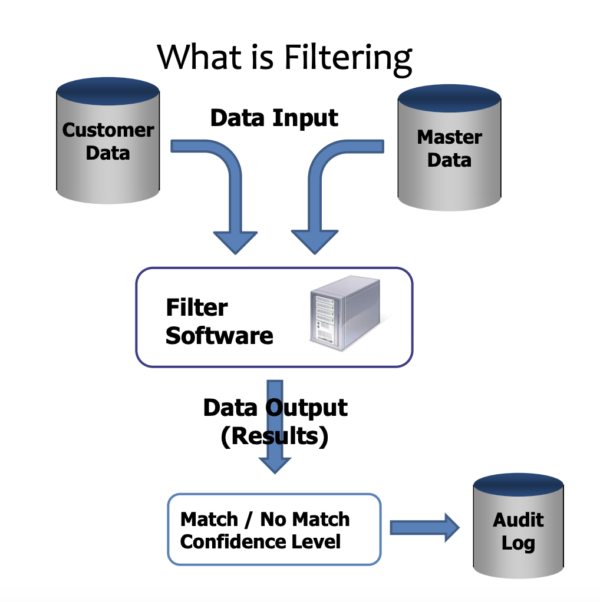

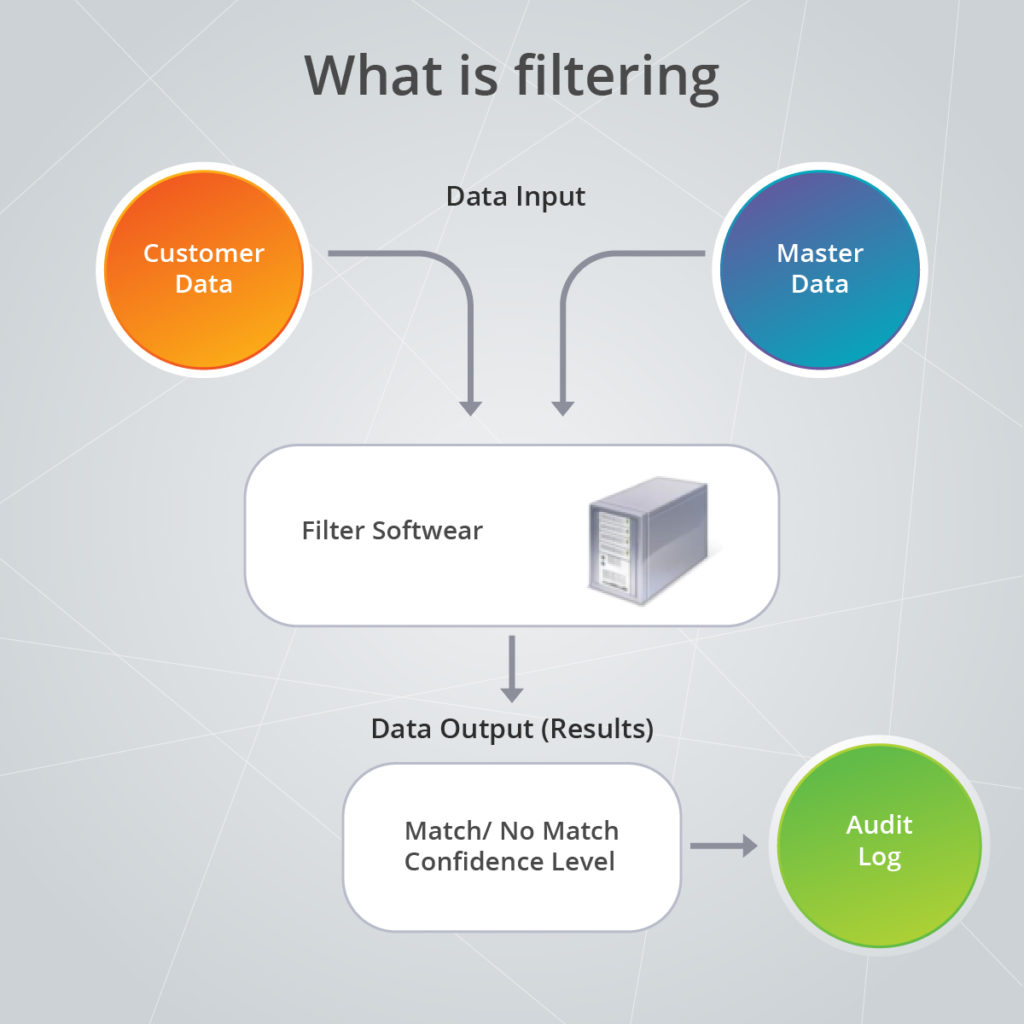

Complying with legislation can be extremely costly and time consuming without the proper solution. One of the biggest problems that organizations face with KYC compliance is false positives. False positives occur when a customer’s identity appears high risk but may not be. Every result that is returned from a KYC screening must be reviewed and that can make large false positive rates very expensive and time consuming. With Sentinel’s advanced filter and name screening science, it has the lowest false positive rate in the market.

Once the user is aware of the customer’s risk status, a decision must be made. High risk customers may not be rejected, but the companies running the KYC checks are now aware that further scrutiny is warranted.

Users may decide if a customer is high risk themselves by the data provided or some solutions, like Sentinel, provide a risk result type for assistance. Some customers may be present on sanction lists and no business may be done with them at all.

Enhanced due diligence (EDD) may be done on some high-risk customers to determine if the risk is worth the reward. These reports include location confirmation, and collection and verification of all data relevant to the company’s reputation. EDD reports provide comprehensive background information on any entity, individual or organization, anywhere in the world. These reports are available from Truth Technologies, learn more on this page.

On-going Monitoring

It is essential that new customers must be screened before they begin doing business with a company, but it’s just as essential that the customers continue to be re-screened as time passes. Oftentimes, businesses will develop a false sense of security when they work with a customer for a very long time. They may work very closely together and have a long history, but this is not a viable substitute for KYC checks. People, organizations, legislation, and situations are everchanging and fluid; therefore, a customer’s risk rating may change over time.

Truth Technologies’ KYC solution allows for continuous customer monitoring, meaning that the user may upload a list of customers and this list will be screened continuously. Any new results immediately trigger an alert to the user. Customer lists can be batch uploaded or entered individuality allowing for constant monitoring to be easy and simple.

KYC Documentation

Not only do regulated entities need to do KYC checks, but they also have to obtain documentation proving it. Auditors will request to see proof that these companies have done their due diligence. Not only do the auditors need to view results, but they also have to see any reasoning behind the decision. If the company decided a high-risk customer was worth it, why? Suspicious Activity Reports (SAR) are documents that financial institutions have to file with FinCEN if there is any suspicion of money laundering or fraud. Currency Transaction Reports (CTR) are documents that must be filed with FinCEN for any transaction involving more than $10,000.

Sentinel allows for users to enter in annotations for every entity reviewed. The reports powered by Sentinel are in-depth, allowing customers to summarize data with multiple filtering criteria. Other reports powered by Sentinel allow the user to produce comprehensive, un-editable audit logs.

Risk of Non-Compliance

This may seem like a lot of trouble, but these regulations prevent criminal activity and terrorism. It is no longer in a company’s best interest to just assume that everything is going great and their customers ae legitimate. These ‘due diligence’ and ‘know your customer’ checks must be completed or the cost can be outstanding.

Fines for non-compliance can be anywhere from thousands to millions of dollars. A money transmitter in London was recently fined £7.8 million for failing to adhere to regulations. Also, HSBC recently agreed to pay a $336 million settlement to end a financial crime dispute in Belgium.

The cost of compliance may be high, but the cost of non-compliance is even higher. A KYC solution, like Sentinel, can greatly aid regulated entities by automating the process and enhancing workflows.